Ledman (300162.SZ) disclosed on December 25th that it has effectively issued 70 million shares at a unit price of 6.59 yuan, aggregating to a capital raise of 461 million yuan. The proceeds are earmarked for the upgrading and expansion of the COB UHD Display Project, alongside the bolstering of working capital.

According to the offering report disclosed by Ledman, the company’s recent follow-on offering attracted subscriptions exceeding 600 million yuan. Ultimately, 11 investors were confirmed as final subscribers, comprising nine institutional investors including prominent entities such as Caitong Fund Management, Nuode Asset Management, Aegon-Industrial Fund, Guotai Junan Securities, and China Asset Management, as well as two individual investors.

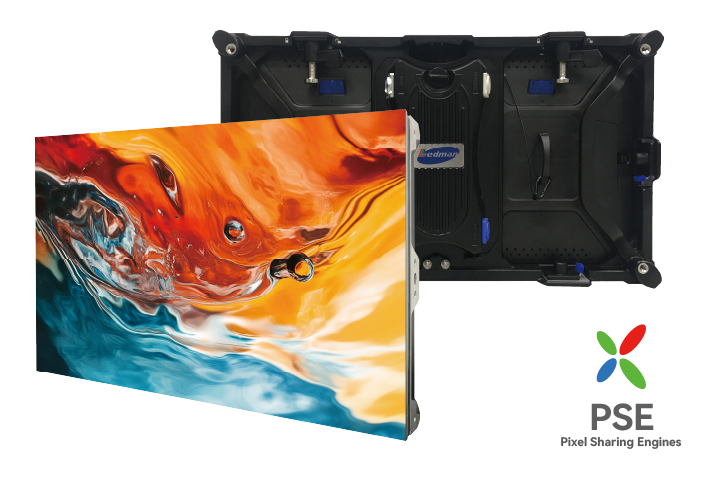

The announcement indicates that the principal investment project for Ledman’s recent follow-on offering is the COB UHD Display Expansion Project. The company asserts that this capital deployment is a pivotal strategic initiative aimed at consolidating and expanding its market presence in the fine-pitch and particularly the Micro LED display sectors. This strategic investment is intended to establish distinctive competitive advantages and enhance market positioning, contributing to a substantial escalation in the company’s sales volume and profitability. It is also expected to bolster the company’s resilience against market volatility and fortify its overall competitive stance in the industry.